✕

6 results

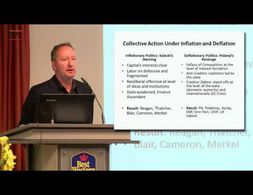

Mark Blyth criticises the political inability to solve the persistent economic crisis in Europe against the background of a deflationary environment. Ideological blockades and impotent institutions are the mutually reinforcing causes of European stagnation. The deeper roots lie in the structural change of the economic system since the 1980s, when neoliberalism emerged as hegemonic ideology. This ideology prepared the ground for austerity and resulting deflationary pressures and a strategy of all seeking to export their way out of trouble. Worryingly this is breeding populist and nationalist resentments in Europe.

In order to describe the global structure of the monetary and financial system and its effects on the global economy, most economics textbooks rely on unappropriated theories that provide nothing but outdated descriptions. In this talk, key speakers in economics, economic history and banking try to make this complex system a little more understandable by relying on real-world insights.

With the onset of an economic crisis that has been universally acknowledged since the end of March, two main questions arise: To what extent is the corona pandemic the starting point (or even the cause) of this crisis? And secondly: can the aid programmes that have been adopted prevent a deep and prolonged recession?

For some days, global financial markets are in turmoil. Central banks and governments are dealing with the unfolding crisis on a daily basis with seemingly u...

This paper attempts to clarify how the European economic crisis from 2007 onwards can be understood from the perspective of a Marxian monetary theory of value that emphasizes intrinsic, structural flaws regarding capitalist reproduction. Chapter two provides an empirical description of the European economic crisis, which to some extent already reflects the structural theoretical framework presented in chapter three. Regarding the theoretical framework Michael Heinrich's interpretation of 'the' Marxian monetary theory of value will be presented. Heinrich identifies connections between production and realization, between profit and interest rate as well as between industrial and fictitious capital, which represent contradictory tendencies for which capitalism does not have simple balancing processes. In the context of a discussion of 'structural logical aspects' of Marx's Critique of the Political Economy, explanatory deficits of Heinrich's approach are analyzed. In the following, it is argued that Fred Moseley's view of these 'structural logical aspects' allows empirical 'applications' of Marxian monetary theories of value. It is concluded that a Marxian monetary theory of value, with the characteristics of expansive capital accumulation and its limitations, facilitates a structural analysis of the European economic crisis from 2007 onwards. In this line of argument, expansive production patterns are expressed, among other things, in global restructuring processes, while consumption limitations are mitigated by expansive financial markets and shifts in ex-port destinations.

"First published more than a decade ago, Globalizing Capital has remained an indispensable part of economic literature. This classic book emphasizes the importance of the international monetary system for understanding the international economy. The second edition, published in October 2008, has consistently appeared on syllabuses since its release

Necesitamos cookies. Pincha en “Aceptar” para ayudarnos a hacer de Exploring Economics una mejor plataforma.